Macrofinancial stability model

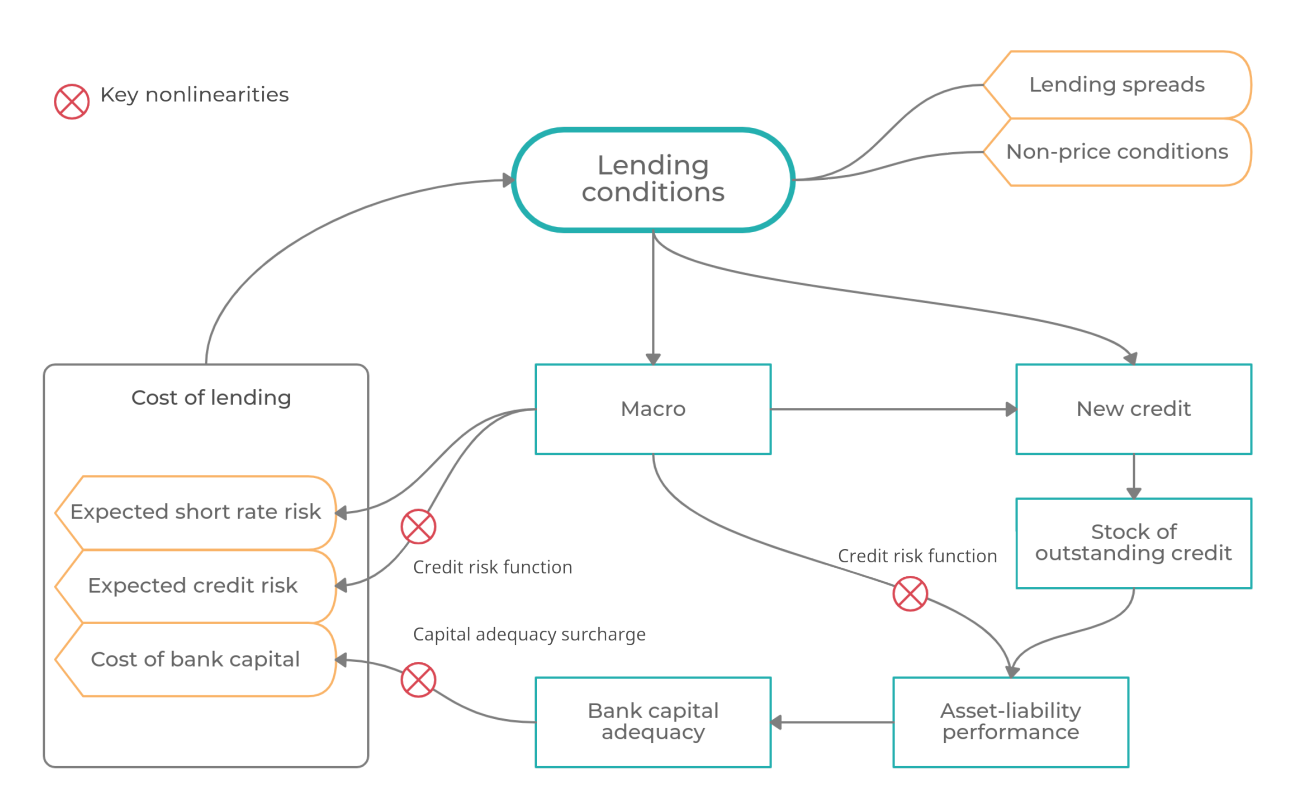

GIMM has developed an innovative in-house modeling framework specifically designed for medium-term dynamic macro-financial analysis. This framework incorporates two-way macro-financial interactions, key nonlinearities, and a flexible array of potential macroprudential policies.

Built upon insights from large-scale DSGE models like MAPMOD, the framework prioritizes simplicity, flexibility, and operational efficiency. It consists of modular components that can be easily added, removed, or adjusted to suit specific needs.

A detailed working paper describing the framework and its use cases is available here.

Crucially, the framework incorporates nonlinearities essential for macroprudential modeling and policy analysis. This allows us to simulate a wide range of policy interventions, not just theoretical "shock-minus-control" simulations starting from equilibrium. We can also build simulations based on the current state of the economy and existing macroeconomic forecasts.

Use cases:

- Policy intervention simulations: Explore how specific policies affect the financial sector and broader economy through simulations. Gain insights into potential outcomes before implementation.

-

Data-driven projections: Generate scenarios for future economic and financial conditions based on current trends and forecasts (like central bank projections). Understand potential trajectories based on real-world data.

-

Shock-minus-control scenarios: Analyze the impact of unexpected events (shocks) on the economy and financial sector compared to a "business-as-usual" baseline. Assess potential risks and their ripple effects.

-

Steady-state analysis: Compare two economic states to understand the impact of changes in underlying factors (parameters) and the path leading from one state to another. Evaluate how long-term policy adjustments might evolve.

Continuous development: We remain committed to updating and enhancing the framework with new features and capabilities.